Crypto Options Volatility Recap

As the crypto market continues its wild chop of ups and downs, implied volatility has been sluggish in recent trading sessions. BTC and ETH IV are dancing closer than ever before, as its spread converges to yearly-lows. Meanwhile, BTC basks in the safe-haven spotlight amidst the banking crisis, as call skew remains sticky on the golden child.

Here is Aevo's options market recap.

Implied Volatility

The beginning of the week saw spot prices retracing from their weekly highs during the Asian session on Monday, but IV failed to respond. As we approached Wednesday FOMC, IV levels started to rise, albeit with less enthusiasm compared to previous FOMCs.

Term structure on both BTC and ETH flipped into steep backwardation as event vol gets priced in, only to see it violently normalise to contango following Fed Powell’s expected 25 bps rate hike.

On Friday, IV experienced a slight uptick ahead of the release of the NFP report, but it quickly got crushed after the U.S. delivered a staggering 253K jobs added in April, surpassing the forecast of 180K, and driving spot prices higher.

Front-end IV on both BTC and ETH currently sits at the bottom of their range.

Source: Amberdata.io, Volmex

Zooming out to a longer time frame, ETH volatility has significantly underperformed BTC volatility, resulting in the convergence of the BTC-ETH volatility spread to its lowest level of the year. Both BTC and ETH volatility have been on a gradual downward trajectory since the FTX incident in late last year.

The most notable recent volatility surge occurred in March, during the onset of the regional banking crisis and the brief depegging of USDC. However, since then, volatility has been on a consistent decline. Without any major FUD events or catalysts, coupled with volatility sellers back in full swing, it is likely that volatility will continue to underperform and remain unresponsive.

Skew

Source: Amberdata.io

Source: Amberdata.io

Looking at skew, an intriguing observation arises regarding the disparity between BTC and ETH. In the case of BTC, near-term skew exhibits volatility as it oscillates between call and put premium territory, while longer-term skew remains in the call territory, likely influenced by a safe haven bid amid the regional banking crisis. On the other hand, ETH demonstrates similar volatility in near-term skew but spends more time in the put territory. Furthermore, long-term options on ETH aren’t feeling that call premium hype as much as BTC does.

Flows

On the flow side, calls have been riding shotgun all week long, steering the bullish ship with gusto. For ETH, Tuesday’s tape caught a jaw dropping scene of 22,000x 12MAY23 2k calls and 7,200x 30JUN23 2.2k calls being snatched up like hotcakes.

Similarly, BTC is also jumping in on the upside action post-FOMC. Near-term trades include 1,075x 12MAY23 31k/32k call spreads, as well as outright 900x 12MAY23 30k calls. Meanwhile, slightly longer-dated trades encompass 1,000 28JUL23 40k/46k call spreads, along with outright 1,175x 30JUN23 30k calls.

As the market chops within its range, volatility sellers are back in full swing, and hungry for more, collecting VRP not only on short-dated tenors but as far as out in September, suppressing longer-term IV and causing the term structure to flatten. The tape observed heavy IV selling throughout the week, with notable trades such as the sale of 450x BTC-12MAY23 28k/31k strangles and 4,000x ETH-29SEP23 1.9k straddles.

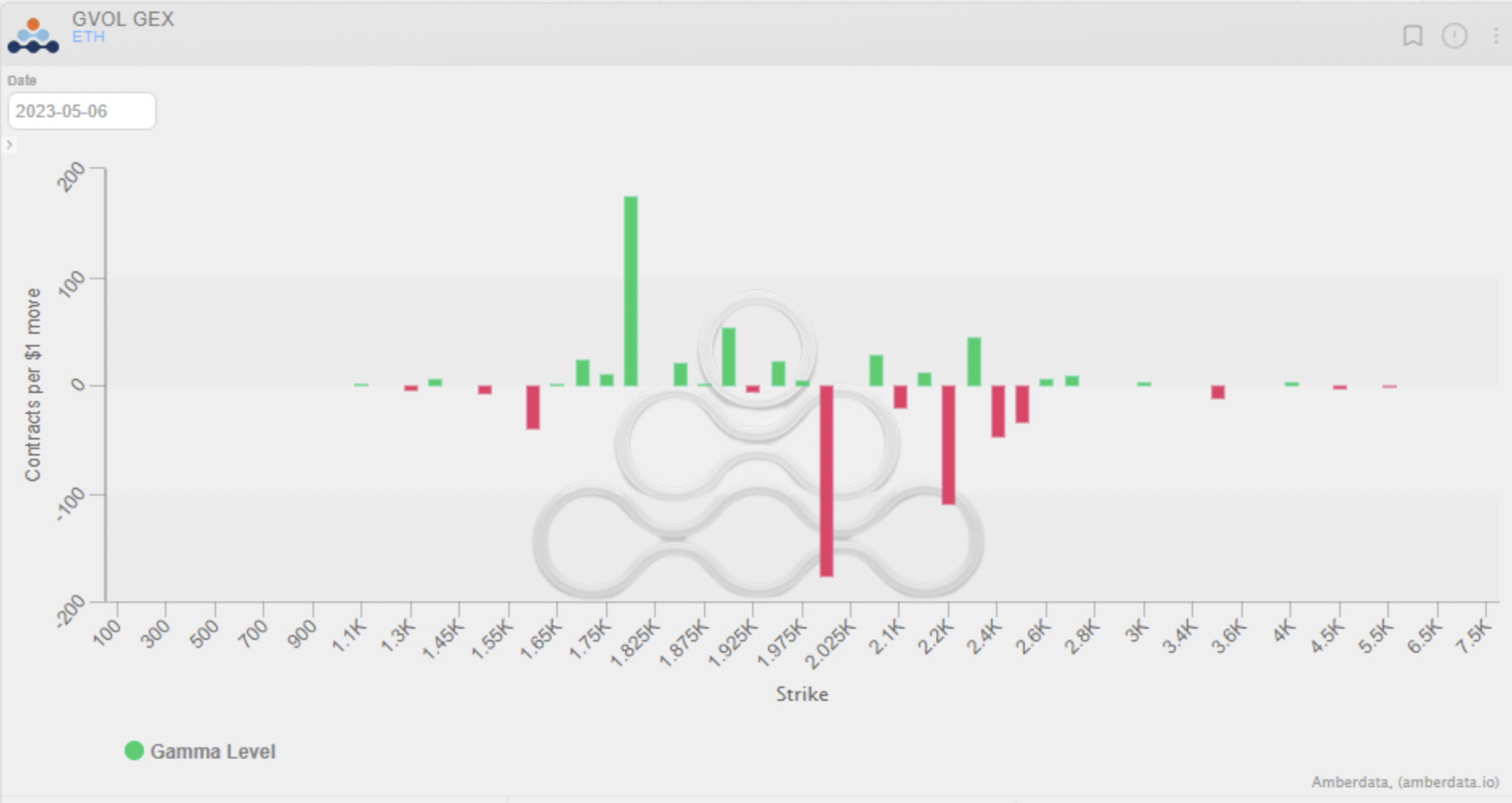

Gamma Positioning

Source: Amberdata.io

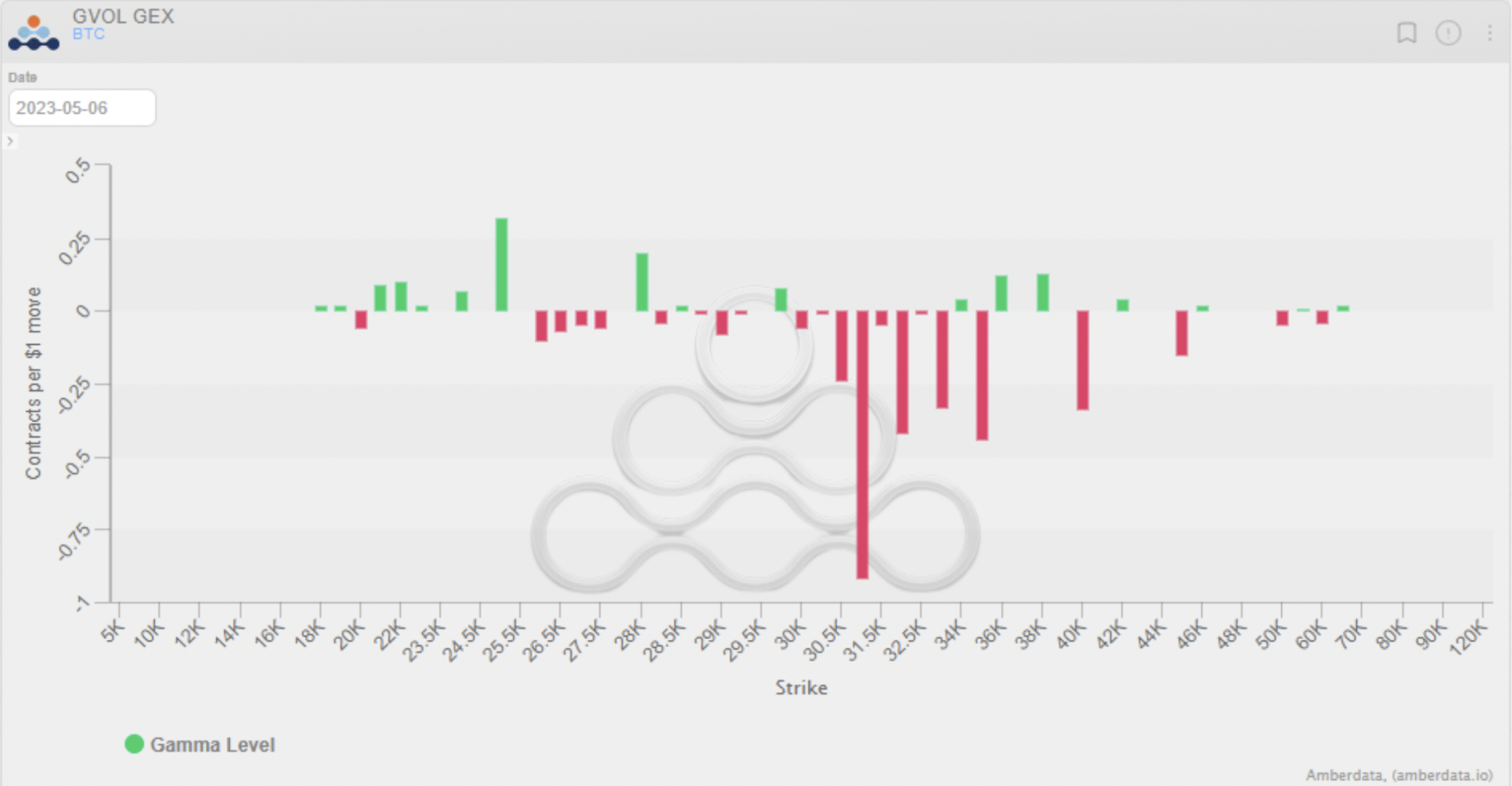

Source: Amberdata.io

Regarding gamma positioning, ETH dealers are predominantly positioned negatively at the 2k strike, while the positive gamma hits its stride at the 1.8k strike, potentially serving as a strong support level.

Conversely, for BTC, surpassing the 30.5k level would shift dealers' gamma positioning to negative, and heavy negative gamma looms at 31k. A break above these levels could send the volatility metre skyrocketing for BTC to the upside. Buckle up, folks!

TradFi Volatility

While crypto volatility has been sleepy lately, the VIX has had its own little adventure, soaring above the 20% handle for the first time since late March before taking a detour back to the 19% and 16% range.

Outlook

Looking ahead, volatility is shouting ‘buy’ from the mountaintops, but without a significant catalyst, it’s hard to see it rewarding vol buyers in the near-term. Similarly, collecting VRP in the short-term may continue to be an uphill battle with depressed vols, explaining why vol sellers are now shifting their focus to longer-dated vols.

Nevertheless, the allure of outright calls or puts to express those daring directional bets is hard to resist at these enticing volatility levels.

Meanwhile, the market is buzzing with anticipation as it prices in the continued dominance of BTC. Calls are being valued at a premium, signalling that investors expect BTC to outshine other cryptocurrencies. This becomes particularly intriguing if a recession pushes the Federal Reserve to cut rates, a move that could greatly benefit BTC. However, if the economy worsens and risk-off sentiment takes hold, ETH on the other hand may struggle to keep up and experience a sharper decline.

Beyond the usual reports from the FOMC and NFP, there are other factors at play. The ongoing banking crisis and the remaining earnings season on Wall Street could inject some much-needed excitement into the crypto market given its historically close ties.

BTC is set to maintain its status as a safe haven, leading the charge in any future rallies. With the banking crisis in full swing, BTC stands as a gold alternative to the US dollar. On the flip side, if a recession hits, ETH's implied volatility could see a resurgence as it may face a steeper decline compared to BTC, given its relatively weaker call skew.

Should the Federal Reserve change its course, BTC could outperform ETH by a larger margin. Such a shift would fuel higher volatility driven by BTC's call skew, giving it an edge over its counterparts.

Trade Opportunities

The current narrowing volatility spread between BTC and ETH presents an interesting opportunity to sell BTC volatility while buying ETH volatility. Selling a risk reversal on BTC, betting on the softening of call skew, could be an appealing strategy. Additionally, ETH puts appear inexpensive considering the relatively low ETH implied volatility. For the bulls, call spreads on BTC can be considered, taking advantage of its current rich call skew, particularly for longer-term durations.

On a shorter-time frame, the upcoming CPI print in May is pivotal as the Fed battles between taming inflation and safeguarding the banking sector. A softer inflation would send risk assets higher, while a higher-than-expected inflation could trigger another risk-off event. Considering the depressed vol levels in ETH, buying straddles here to long vega presents an enticing trade opportunity.

Aevo Exchange

A month ago Ribbon Finance launched a gated mainnet of Aevo Exchange - a decentralized derivatives exchange built on Aevo Chain, an optimistic roll-up to Ethereum that runs on an OP Stack. Aevo operates an off-chain orderbook with on-chain settlements. This means that once orders are matched, trades get executed and settled with smart contracts.

Aevo currently focuses on ETH options and will soon add the perps market along with the BTC pair eventually allowing for more traders to customize their trading strategy such as delta-hedging positions to support their market views.

If you’re a whale or options pro trader, reach out here!