Liquidity Mining Retrospective

Ribbon executed its first Liquidity Mining program from June 18th to July 16th 2021. The main goals of this program were to:

Grow the metrics of the protocol (TVL, user numbers, etc.)

Increase distribution of RBN beyond the initial airdrop recipients

Experiment with RBN rewards as a way to acquire users

This post is aimed to be a retrospective on the successes/failures of the Liquidity Mining program, and dives into the data.

Key Metrics

Ribbon had 3 vaults that provided RBN incentives throughout this period:

ETH Covered Call Vault

WBTC Covered Call Vault

ETH Put Selling Vault

We measure two metrics for each individual vault to see how the LM affected them: TVL and User growth. We also look at the growth of RBN holders as a key metric.

Total Deposits a.k.a TVL

All three vaults saw significant growth in TVL from when we proposed the LM Program on June 7th.

The ETH Covered Call vault was sitting at approximately 5,000 ETH when we announced the LM Program. Over the following week, deposits doubled to 10,000 ETH. By the time the LM program was executed, the ETH vaults were at full capacity. They remained full until the end of the LM program.

The BTC Covered Call vault had very similar growth. It was sitting at approximately 280 WBTC when we announced the LM Program. Over the following week, deposits almost doubled to 500 WBTC, which was the cap of the WBTC vault. They remained full until the end of the LM program.

The ETH Put Selling vault also saw significant growth in depots. It was sitting at approximately ~9.5M USDC when we announced the LM Program. Over the following week, deposits doubled to 20M USDC, which was the cap of the vault. They remained full until the end of the LM program.

User Count

All three vaults saw growth in User Count from when we proposed the LM Program on June 7th.

The ETH Covered Call vault had approximately 912 users when we announced the LM Program. By the end of the LM program, this vault had 1213 users, representing a 33% increase.

The WBTC Covered Call vault had approximately 237 users when we announced the LM Program. By the end of the LM program, this vault had 317 users, representing a 33% increase.

The ETH Put Selling vault had approximately 281 users when we announced the LM Program. By the end of the LM program, this vault had 640 users, representing a 127% increase.

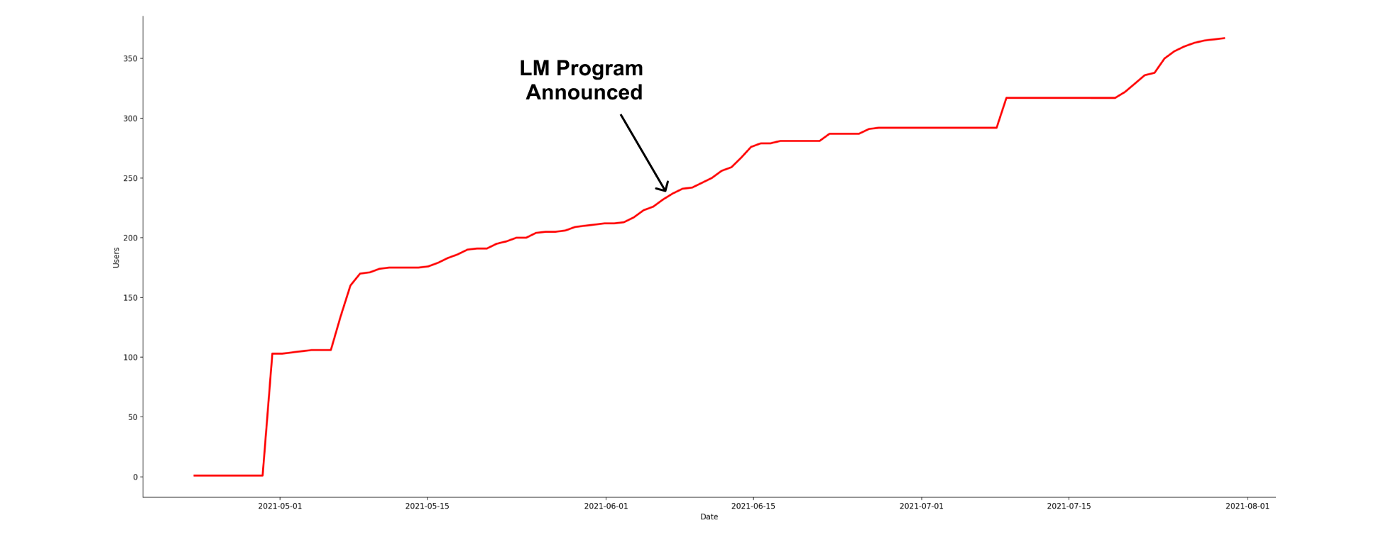

Growth in RBN Holders

One of the main goals of this LM program was to increase the number of RBN holders.

The initial airdrop distributed RBN to 1620 Ethereum addresses. 2 months after the airdrop, approximately 1140 users (~70%) have claimed their airdrop distribution.

This LM program increased the number of eligible RBN holders to 2125, an increase of 505 new addresses (~30%) from the program. So far, over 350 of those addresses have claimed their RBN.

Detailed Breakdown of LM Program

Breakdown of Reward Distribution

We also investigated the breakdown of rewards per vault, getting the number of users who stayed until the end of the program, the number of early withdrawers, and the average/median/max/min rewards in every vault:

ETH Vault

Num of stayers: 562

Num of early withdrawers: 29

Average: 5447.15

Median: 667.54

Max: 300346.60

Min: 0.67

WBTC Vault

Num of stayers: 199

Num of early withdrawers: 5

Average: 15286.54

Median: 3207.35

Max: 600020.47

Min: 15.47

USDC Vault

Num of stayers: 396

Num of early withdrawers: 45

Average: 9366.56

Median: 848.80

Max: 305052.97

Min: 0.072

“Stickiness” post LM

Another metric that we measured was the “stickiness” of the capital that entered our vaults post-LM program. This is important because it gives us a sense of how much product market fit that the Ribbon vaults have, and paints a picture about how mercenary the depositors are. For example, if the vault was capped at 10,000 ETH and there were 5,000 ETH of withdrawals immediately after the LM program ends, it shows that over half of the capital is from mercenary “farm-and-dumpers”.

We attempt to measure “stickiness” by looking at the withdrawals from the vaults after the LM program ends. We define a new metric called “Mercenary Capital”, which is the total withdrawals 1-week after the LM program ends, divided by the amount of assets at the end of the program. For example, 50% Mercenary Capital means that 50% of the capital was withdrawn within 1-week of the LM program ending.

ETH Vault

Num of withdrawals: 59

Total withdrawals: 3267.12 ETH

Mercenary Capital: 26%

WBTC Vault

Num of withdrawals: 18

Total withdrawals: 68.38143 WBTC

Mercenary Capital: 11%

USDC Vault

Num of withdrawals: 76

Total withdrawals: 4,390,834.48 USDC

Mercenary Capital: 18%

Conclusions & Learnings

We believe this LM program was successful in many ways — it drove >2x increase in assets on the platform, 30%+ increase in the number of users, and over 30% new RBN holders.

Secondly, we have much stronger conviction in Ribbon’s product market fit because of the “stickiness” data. Although some of the vaults had 26% in Mercenary Capital, we saw that the vaults filled up back to previous all-time-highs despite these large mercenary whales withdrawing from them.

On the flipside, one of the main issues with interpreting the data from this program was the fact that the vaults were capped. For example, the 2x increase in vault deposits in the USDC vault from the LM program could simply be a function of pent-up demand getting released when we increased the vault caps, instead of getting a clear picture of the RBN incentive’s impact on vault deposits. However, as we scale and launch Ribbon v2, we can likely uncap the vaults and get a more accurate picture of the real demand for these products. The capped vaults also created an artificial limit to how many new users could earn RBN in this program. Unfortunately, many new users who learnt about Ribbon and the LM program were unable to participate because of the vault caps.

We also feel that the growth in RBN holders was underwhelming. While assets on platform grew by 2x, the number of actual addresses that was able to acquire RBN was fairly small. If we were to design a new LM program, we will likely try to innovate on this aspect the most, to improve distribution among real users.

This post is cross-posted on our Governance Forum.