Options Strategies: Butterfly

Over the summer, we saw an inordinate amount of Calls being traded on Ethereum due to the impending merge. Interestingly, most of these Calls have been part of a structure known as a Butterfly strategy. The Butterfly is a relatively less known options trading strategy that is used to exploit the price movement of an underlying asset while at the same time lowering your risk of a loss. In this article, we want to simply explain the Butterfly strategy and why traders use it while using an example.

When trading options it’s worth remembering that options prices move non-linearly, meaning if ETH jumps in price by $100 the value of your options won’t necessarily increase by $100. Inversely, if ETH crashes by $100 your options might not decrease by that same $100. This mitigation of risk is something the Butterfly is really good at.

What is the Butterfly Strategy?

A Butterfly strategy is usually executed when an investor thinks that the price of an underlying asset will remain within a limited range (between two strike prices). This specific strategy is less risky than some of the other options strategies, but at the same time it offers an above average potential for gains in case your prediction turns out to be correct.

To put it simply a Butterfly involves buying and selling (or “writing”) three option contracts equidistant from each other with different strike prices but the same expiration date. Let's look at an example:

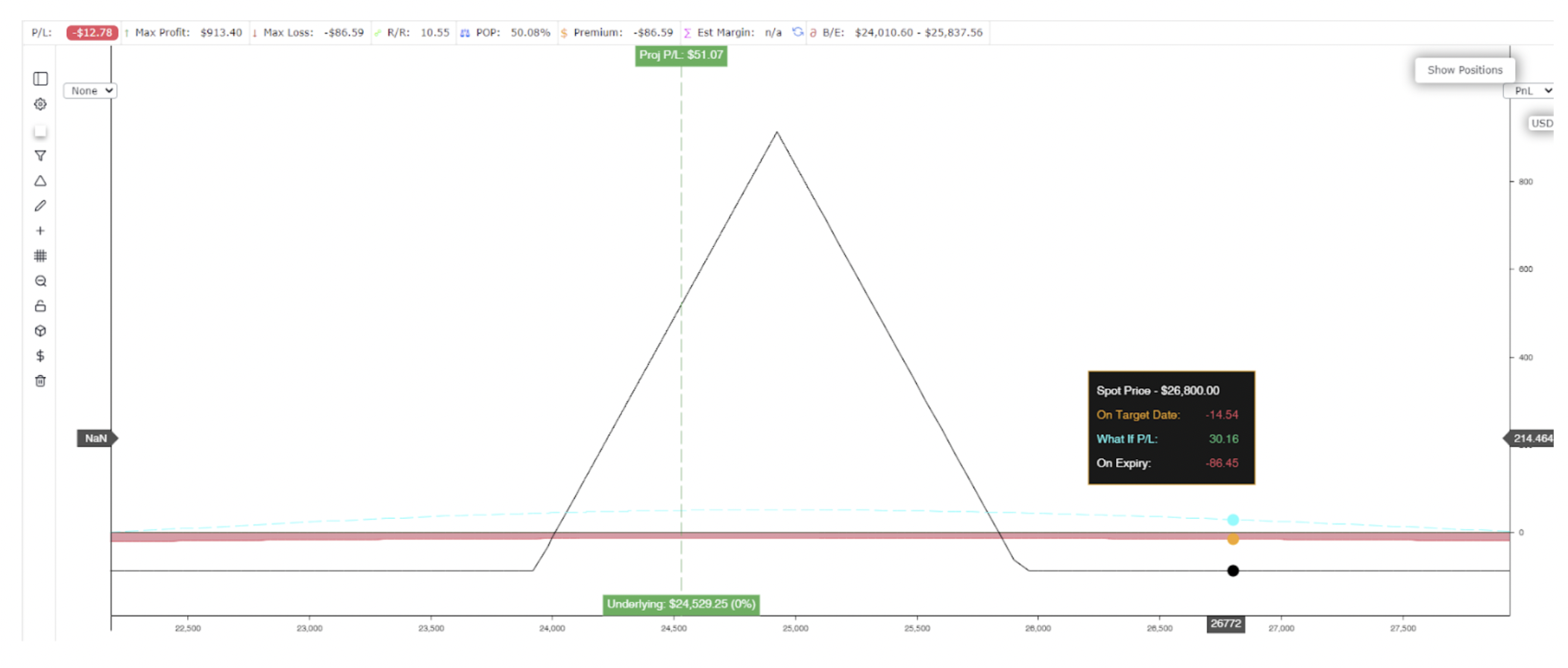

Buy 1x 30SEPT 24k Call

Sell 2x 30SEPT 25k Call

Buy 1x 30SEPT 26k Call

The chart below illustrates what would happen if the price of Bitcoin were to be trading between the two long Calls at the time of expiry. In our example, the max profit is capped at around $900. Put in another way, the absolute most we could make is $900 if at the time of expiry BTC was trading smack in the middle of our two widest strike prices.

Next we want to draw attention to three things: first, the strike prices are equidistant from each other, second, they all have the same expiry date, and third, our overall portfolio has an equal amount of long and short Calls that will offset the gains and losses above and below a certain price - meaning you have defined risk. A little arithmetic will prove this, just remember we have to pay a premium for buying Calls, and we receive a premium for selling Calls. The calculation ends up looking something like this:

1 Long 24k Call = -$2,637

2 Short 25k Calls = +$4,300 ($2,150 each)

1 Long Call 26k = -$1,750

Total structure cost = $87

No matter what happens, $87 is the max amount of money we can lose, because, as previously stated, the equal amount of long and short Calls offset each other past certain points so all that's really at risk is the net premium paid. This is what’s known as defined risk. The two charts below illustrate what happens if the price is trading too high or too low at the time of expiry. You can clearly see “On Expiry” that the loss is around $86 on either side.

So the Butterfly is a limited profit and limited risk strategy that is suitable for both beginners and advanced traders. But how are the professionals using this strategy at the moment? In the example above, our structure was centered around where Bitcoin was trading at that moment, however, traders are betting that the price of Ethereum (specifically) increases on the back of the merge narrative, so they have slightly altered the trade. Instead of buying their Butterfly around the current price at the time, they seemed to have moved out the strike ladder a bit. Let’s show you:

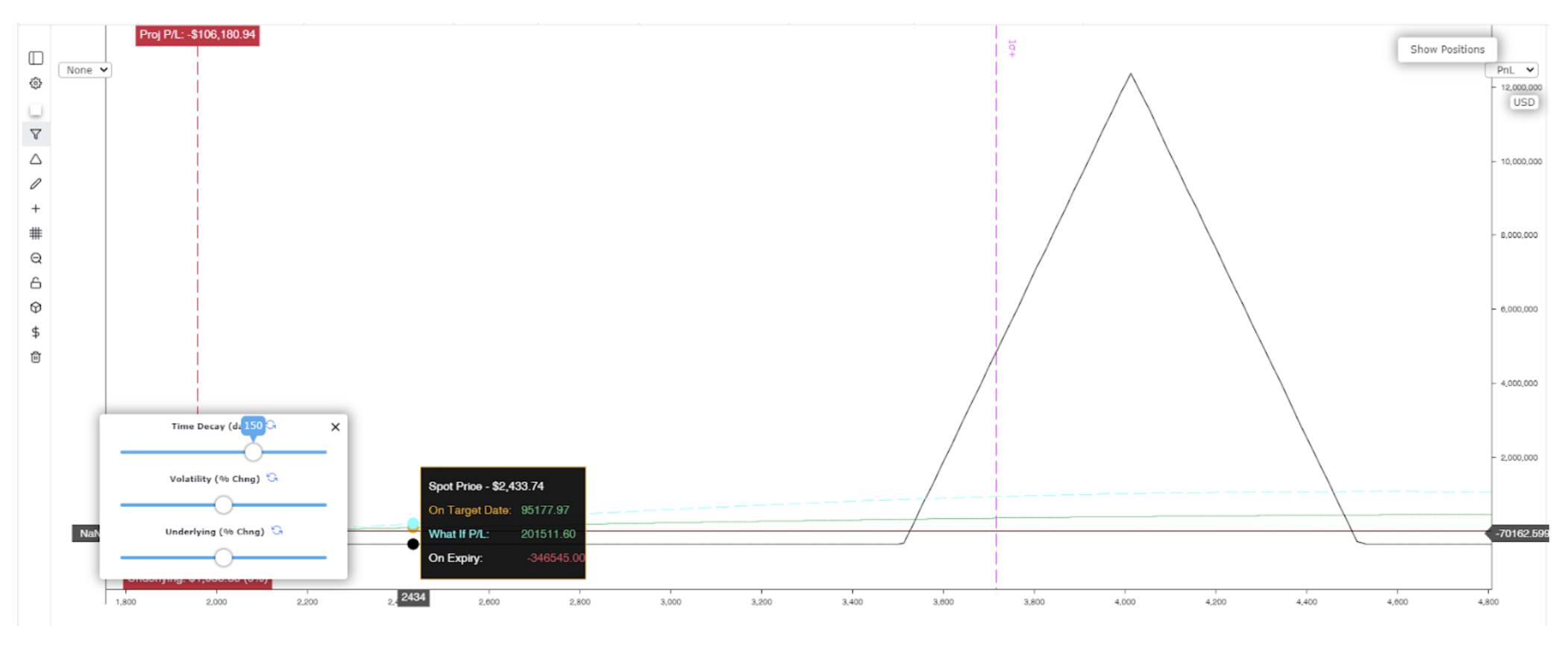

This is a bit of an extreme example but in August someone bought 51,000 Call Butterflies expiring in March 2023 with strikes of $3500, $4000, and $4500. Now, if this trader was to hold until expiry (which they probably wouldn’t do) and ETH was trading below $3500 or above $4500 they would crystallize their max loss which would be ~$346k. However, if ETH is trading within that range, it looks as if they have a potential max profit of $12M.

The great part about this trade is that even if $ETH moves up to $2400 in 150 days the trader will be sitting on a profit of about $200k.

Note: The numbers will actually be better than illustrated, because these graphs were built on August 14th at a time when ETH is trading around $2k. The actual trader got in at a much lower price.

What are the risks of the Butterfly strategy?

Like all options strategies, Butterflies do have some risks associated with them. The main risk, as we have discussed, is that the price of the underlying doesn’t land within your strike prices at the time of expiry, but we are also open to leg risk - when each leg of the option doesn’t execute at the same time for the desired price. This is something to discuss at a later time, for now, it’s only important to know that this risk exists. Traders ultimately enjoy using the Butterfly structure because it allows for fairly decent upside with very limited downside risk, and you don't need to hold them until expiry to make a profit.

Butterflies are an extremely flexible options strategy that can be used to profit from a change in the price of the underlying asset, or from Theta decay. Like any other trading strategy, you must always be aware of your capital allocation and how much you are willing to risk. The Butterfly strategy is not overly complicated, and in the end, it all comes down to determining the potential return that you are willing to accept versus the potential loss that could occur.